Guides

Introduction to DeFi

What is DeFi?

As you dive deeper into Web3 you'll hear many terms used quite often, DeFi will stand to be the most common and important concept to start your journey.

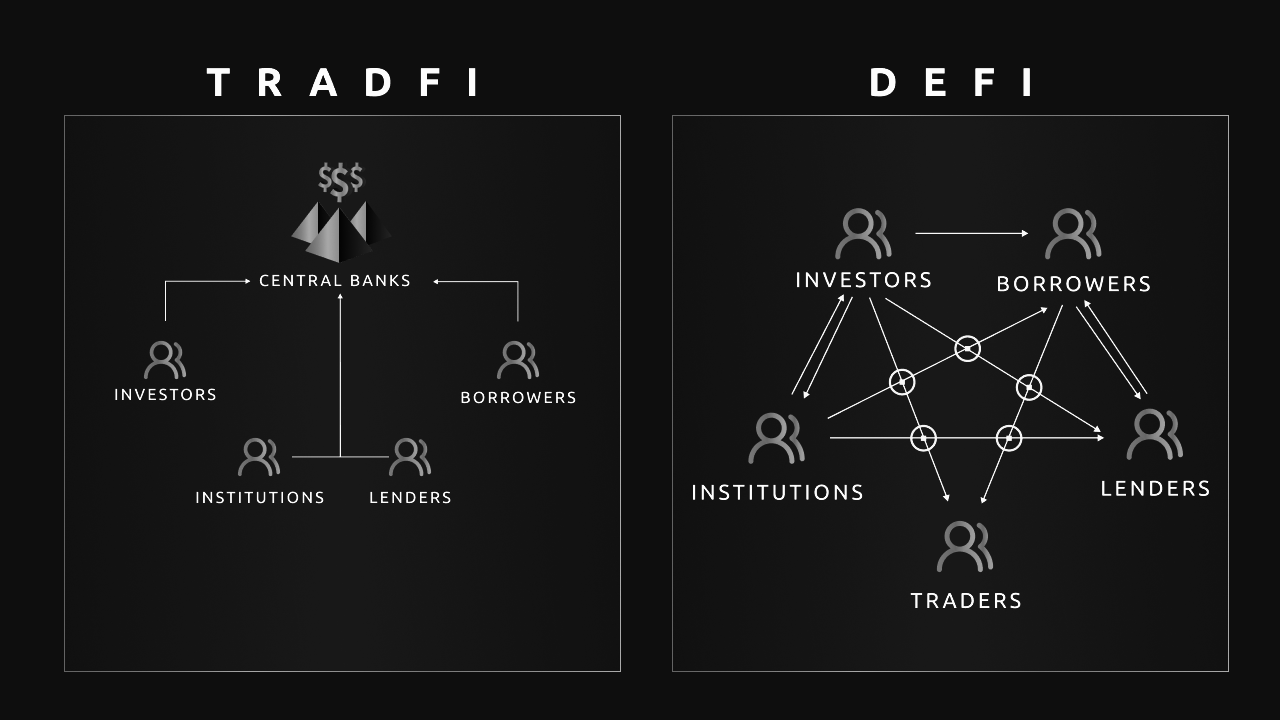

DeFi, short for Decentralized Finance, is a method to revolutionize traditional finance systems by leveraging blockchain technology and smart contracts and creating a suite of tools and financial services for ANYONE to use. Unlike traditional finance, which relies on centralized institutions like banks, DeFi operates on decentralized networks and thus is not bound by middle-men and intermediaries.

Loans, exchanges, and custody all being deployed and governed by the communities and developers alike. The biggest takeaways on DeFi compared to TradFi is intermediary-free, permissionless, and trustless

One of the key features of DeFi is its openness and transparency. Since transactions are recorded on a public blockchain, anyone can verify the integrity of the system and track the flow of funds. This transparency helps to build trust among users and reduces the risk of fraud or manipulation.

Overall, DeFi has the potential to disrupt traditional finance by offering a more inclusive, efficient, and transparent alternative. However, it's important to note that DeFi is still a relatively new and evolving field, and there are risks associated with using DeFi protocols, such as smart contract bugs and security vulnerabilities. As the space continues to develop, it will be crucial for users to educate themselves and exercise caution when participating in DeFi activities.

Now that we have a better fundamental understanding of this new term let's break down how to engage in this vast landscape of smart contracts, financial services, and fast paced environment.